Let's Talk Tax Rates

Great news: since I have been on Council, tax rates have gone down!

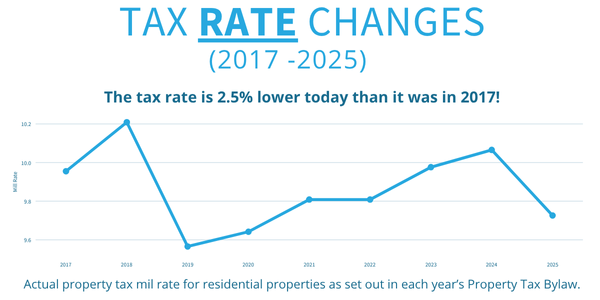

Don’t believe me? You can access the Property Tax Bylaws here. If you graph out the Low Density Residential rates, this is what you will find:

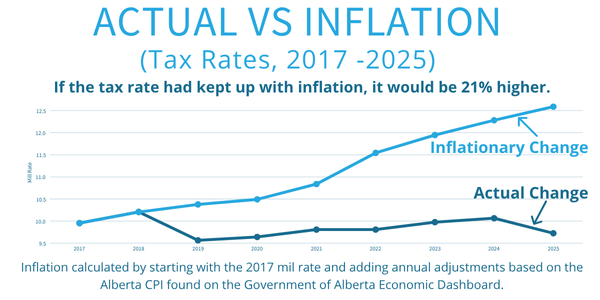

This decrease is especially remarkable when you think about Alberta’s inflation numbers. Here is what the tax rate would’ve looked like if it had matched inflation vs how it actually changed.

This seems like a great news story! Council has actually lowered taxes! We should be proclaiming that loudly!

So why don’t we?

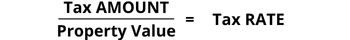

Because it isn’t actually a good view of Council’s financial performance. Because a tax rate, on its own, tells you very little. Why is that? Because look at how we calculate the tax rate:

Your tax RATE is driven by property value just as much as it is driven by the tax AMOUNT you pay. That means that as as house prices increase, a lower RATE is needed to get the same AMOUNT of taxes.

Which makes the tax RATE a very poor measurement of City finances. Because Council has minimal impact on the housing market. What your house is worth has no impact on City spending. And most important: when it comes to how much money is coming out of your pocket, the tax RATE is only half the story. On its own, it doesn’t mean anything. We can’t talk about the impact of changes in tax RATES without also talking about changing property values.

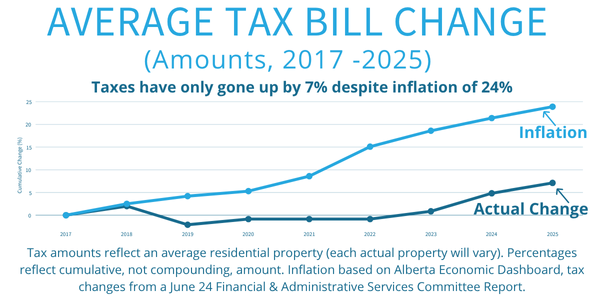

And just because the RATE has gone down doesn’t mean that the AMOUNT has gone down. In fact, quite the opposite. Although tax AMOUNTS have gone up by less than half the rate of inflation, they have gone up (more on that below).

Let’s re-arrange that equation from above:

Tax AMOUNTS have gone up even while RATES have gone down. Why is that? Because property values have also gone up. Rates have done down partly because of Council’s hard work to control costs. But it has also gone down because house prices have gone up.

Above, I have shown how tax RATES have gone down. I could use that data point to pat myself on the back and talk about how great Council has done. But I would never do that because that is only telling half the story. On its own, the RATE going down doesn’t tell us anything about how much the City is spending or how taxes are impacting residents. If I tried to talk vocally about how I have been part of a Council that has reduced taxes, most residents would (quite rightly) not accept that.

the problem with rate comparisons

I would never tell the half story of tax RATES going down to brag about taxes going down.

So I will admit frustration when only half the story is told to spin Grande Prairie City finances being way out of line with other cities.

I often hear people (including Candidates) say something like “Grande Prairie has some of the highest property taxes in the province!” But when they say that, they are comparing RATES. Which are meaningless if we aren’t also looking at property values.

Usually when I hear concerns about our taxes, this report by Zoocasa is cited. It correctly lists Grande Prairie as having the second highest tax rate in the province. Just above us is Wetaskiwin. If you look at the top of the list, the cities with the lowest rates are Canmore and Chestermere which have a rates ~60% lower than Grande Prairie.

So what is driving that difference? Is it that Canmore and Chestermere spend ~60% less than Grande Prairie and Wetaskiwin? Absolutely not. The primary driver of this massive difference isn’t municipal decisions. Rates are so different in the province because housing markets are so different. A municipality with high house prices can charge a very low RATE while still generating a high AMOUNT of taxes. And a municipality with low house prices will need to charge a high RATE to get an average AMOUNT of taxes.

Canmore doesn’t have the lowest tax rate in the province because it spends very little money. It has the lowest rate because it has the highest priced houses.

And Grande Prairie doesn’t have a higher tax rate than other cities because we spend more than them. We have a higher tax rate because houses are far more affordable in Grande Prairie.

focus on rate or amount?

We want to know that our money is spent well. To do that, benchmarking is important. One of the best ways to measure our financial performance is to compare it to other cities. We want to meet or exceed the benchmarks that are important to us.

For many, the tax RATE is an important benchmark. They want Council to set a rate about the average of other cities. They then want us to plug that rate into this equation:

In principal, I sort of get why people want Council to go this route. But this has three major problems:

Our housing market is on an upswing. If we are focused on tax rates, then that means tax amounts will go up as the housing market heats up. If houses across Grande Prairie go up by 20% over the next few years but we kept rates the same, residents would be paying 20% more taxes. That isn’t necessary or reasonable. If houses go way up in price, rates should be going down to compensate. Not staying the same.

If we are going to set a rate that is the same as cities with higher property values, that means we are going to collect less taxes. Which is a problem. Property values don’t drive most municipal costs. Just because a house costs less in Grande Prairie doesn’t mean it costs less here to buy a firetruck, hire a lifeguard, or purchase asphalt. If we are determined to have rates equal to places with more expensive houses, then that means that we need to accept that our City will offer much less services than those other cities. I don’t think most residents want that.

The housing market fluctuates dramatically. If we keep rates consistent while the housing market goes up and down, then the total tax amount people pay is going to change dramatically very year. This is stressful and difficult to manage for families and businesses. It would also be difficult for the City to manage: its budget would have huge variances every year, making it very difficult to provide efficient and consistent services.

Because of those problems, I’m not personally very focused on tax RATES. Instead, this is the equation we should be using:

We should be focusing on tax AMOUNTS.

We should be benchmarking our tax amounts to other cities, working hard to have residents in Grande Prairie spend about what residents in other cities spend (while making sure our services are as good or better as those other cities).

We should be controlling the amount the City collects, maximizing every dollar and not requiring people to pay more than is needed to meet the community’s desired levels of service. We shouldn’t collect more money just because house prices go up.

Finally, we should be keeping tax bills predictable. As inflation increases costs to the City, tax bills will need to go up overtime. But to help citizens and businesses budget, they should go up by a little bit at a time. They shouldn’t have the huge fluctuations we see in property values.

When I’m looking at the City budget and evaluating our performance, I look at our tax AMOUNTS. Not our tax RATES.

Which leads to an important topic:

Above, I showed how tax rates have gone down overtime. But if those aren’t super relevant, then I should also talk about tax amounts….

a word about affordability

Following, I’m presenting numbers that show how taxes have changed over time and how our finances compare to other cities. They demonstrate that Council and staff have been very disciplined with money. Through striving for efficiency and pulling back on low priority programs, we have minimized the impacts of inflation and other budget pressures on taxpayers. Compared to other cities, our spending is about average we have tightened our budgets significantly.

I’m proud of this work.

However, I recognize that many families are struggling. Affordability is a HUGE concern in our community. And property taxes are a significant bill. I don’t want to in anyway minimize that. It is always top of mind to me when we talk City budgets. I don’t support slashing City programs because the residents who have the greatest struggles are often hurt the most by service reductions while benefitting the least from tax cuts. However, I want us to spend as little as possible on delivering these services. Council needs to be very focused on maximizing every single dollar we spend.

To see some of my ideas about how to do that, please checkout my Platform. Two key planks in it: “Focus on the Boring Stuff” of good governance and fiscal discipline, and “Affordability.” I’d love your feedback on my specific ideas!

tax amount changes over time

I could look at just tax rates and claim taxes have gone down over my time on Council. But again, that is only half the story. I wouldn’t claim that. Because the reality is, people are paying a little bit more today than they were before. City costs have increased, so taxes have had to go up.

However, I am very proud that tax bills have gone up way less than almost every other bill. Here is what tax changes over my time on Council look like compared to inflation:

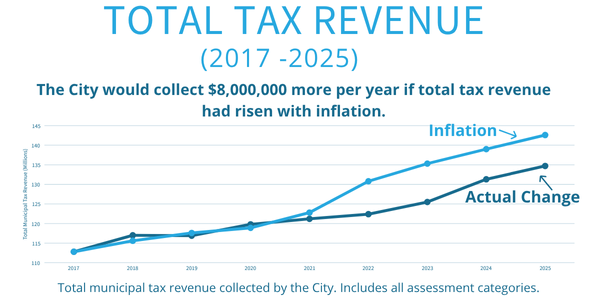

Of course, average residential tax bills are just one glimpse at how the City is doing. Council has reduced spending. But we’ve also attracted new development that pays taxes and slightly increased how much non-residential properties pay compared to residential. For a fuller picture of what tax control has looked like, it is also worth looking at the total amount of dollars collected:

When talking about tax increases, it is also important to note the pressures the City budget has faced.

Just like every other organisation, the City is facing escalating costs. It costs more to buy a grader, hire road crews, or purchase electricity than ever before. Additionally, the City is spending more because residents have requested new services. Since 2017, we have added the Hansen Lincoln Grandstands, Outdoor Pool, Mobile Outreach Program, Free Youth Transit, various community events, Keyera Place in Smith, and driveway windrow removal to City offerings. Additionally, RCMP members unionized and received a very large [but also well deserved] raise, massively increasing our costs for policing.

We have also faced a revenue squeeze from the province. The province has drastically reduced infrastructure funding across the province. It now takes a larger percentage of revenue from fines than it used to. And for many years, it reduced how much it pays for municipal services to provincial buildings by half. It’s also worth noting that the province is drastically increasing its property taxes (it is projecting a 33% increase from 2024-2026!). While this doesn’t directly impact the City budget, it certainly is collected by the City and so is felt by residents when they pay their tax bills.

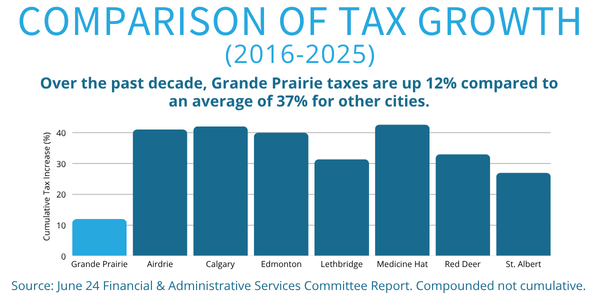

None of these pressures are unique to Grande Prairie. All cities are facing inflation, demand for new services, and provincial cuts. In response, all cities have increased their taxes. However, Grande Prairie has seen a much lower increase than others. Here is how we stack up: